2021: The Year of Memecoins on Binance Smart Chain

In 2021, the crypto market exploded with memecoins, and Binance Smart Chain (BSC) became their go-to launchpad. The network’s low fees, lightning-fast transactions, and no-nonsense token creation made it the perfect playground for traders chasing the next big thing.

Memecoins Riding the 2021 Crypto Waves

The year started with the hype around DeFi, then came the NFT mania, and by the end of the year, everyone was talking about the Metaverse after Zuckerberg’s announcement. But through all these shifts, memecoins refused to fade. Powered by internet culture, memes, and pure market chaos, these tokens delivered some of the most insane gains of the year.

BSC Goes Parabolic

At the beginning of 2021, BSC barely had a footprint—just 350,000 daily transactions, 50,000 active users, and about 200 dApps. But by year’s end, those numbers had gone wild:

- 7M+ daily transactions (ATH: 16.26M on Nov 25)

- 1.3M active users per day (ATH: 2.27M on Dec 1)

- 1,150+ dApps spanning everything from DeFi to GameFi and NFTs

- 2.14B total transactions on BSC in 2021

- 123M new wallet addresses added globally

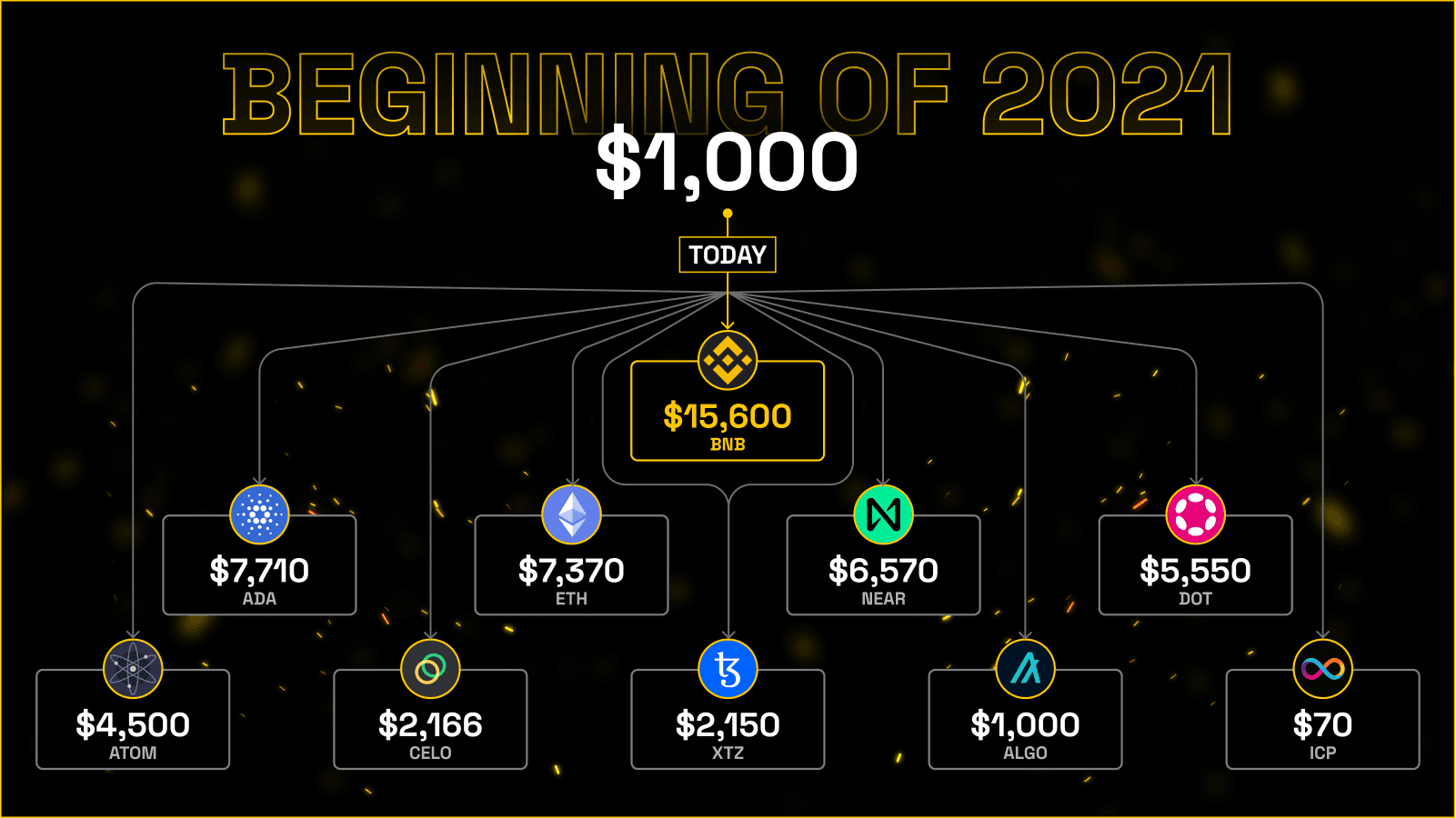

This wasn’t just growth—it was a full-blown migration. Traders, devs, and projects ditched high-fee chains like Ethereum and flooded into BSC, creating the ultimate breeding ground for new tokens, including memecoins that 100x’d overnight.

Why Did Memecoins Explode on BSC?

- Dirt Cheap Fees – On Ethereum, gas fees were a joke, hitting $50-$100 per trade. On BSC? A few cents.

- Anyone Could Launch a Token – Using BEP-20, devs could drop a new coin in hours, no deep coding knowledge required.

- Social Media Frenzy – Twitter, Reddit, and TikTok pushed memes into the mainstream, turning coins like Dogecoin into household names.

- DEX Freedom – No need for KYC or centralized exchanges. PancakeSwap and other DEXs made it effortless to trade new coins.

- The Lottery Mentality – Everyone was looking for the next 1,000x trade. Many actually found it… until they didn’t.

- COVID Changed the Game – With people stuck at home, online trading became the new casino. Boredom and stimulus checks fueled speculation.

- Retail Traders Took Over – The GameStop (GME) short squeeze in early 2021 proved that retail traders could move markets. The same mob mentality hit memecoins hard.

- Easy Money Printing – More than 40% of all U.S. dollars in circulation were printed after 2020. Extra cash meant extra risk-taking.

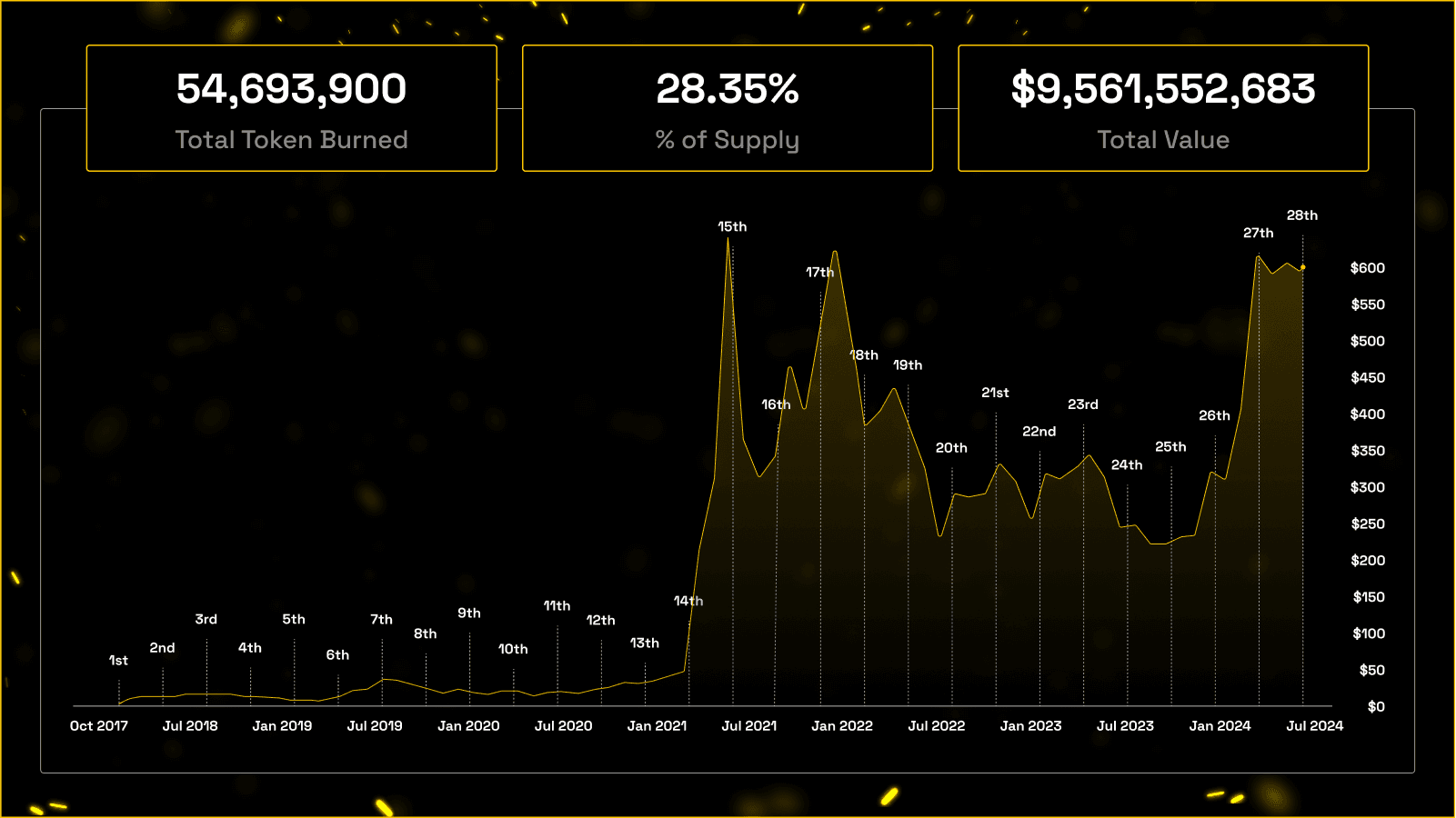

Bnb token burn overview

The year 2021 marked a significant shift for memecoins on Binance Smart Chain, and the token burn data reflects this trend. There was a noticeable increase in activity during the middle of the year, as memecoins gained widespread attention and more liquidity entered the ecosystem. The highest burn phases, particularly during the 15th, 17th, and 18th cycles, aligned with periods of strong interest in these tokens, contributing to higher demand and price increases. In the years that followed, market fluctuations continued, but the burning mechanism remained an important factor in reducing supply and supporting value. The recent price peak in 2024 further demonstrates that deflationary models continue to influence on-chain markets, especially for rapidly growing assets like memecoins.

GameFi & NFTs Added Fuel to the Fire

Memecoins weren’t the only wild west on BSC. GameFi blew up, contributing to over 50% of all transactions. Blockchain-based games—MMORPGs, battle arenas, racing, card games—thrived on cheap fees and fast transactions.

Meanwhile, NFTs became serious business. The Pancake Squad NFT collection alone moved over $40M in trades. Binance NFT, NFTrade, and metaverse projects like MOBOX and Alien Worlds kept pushing the boundaries.

The Good, The Bad & The Ugly

Winners:

- Retail traders finally had access to early-stage crypto

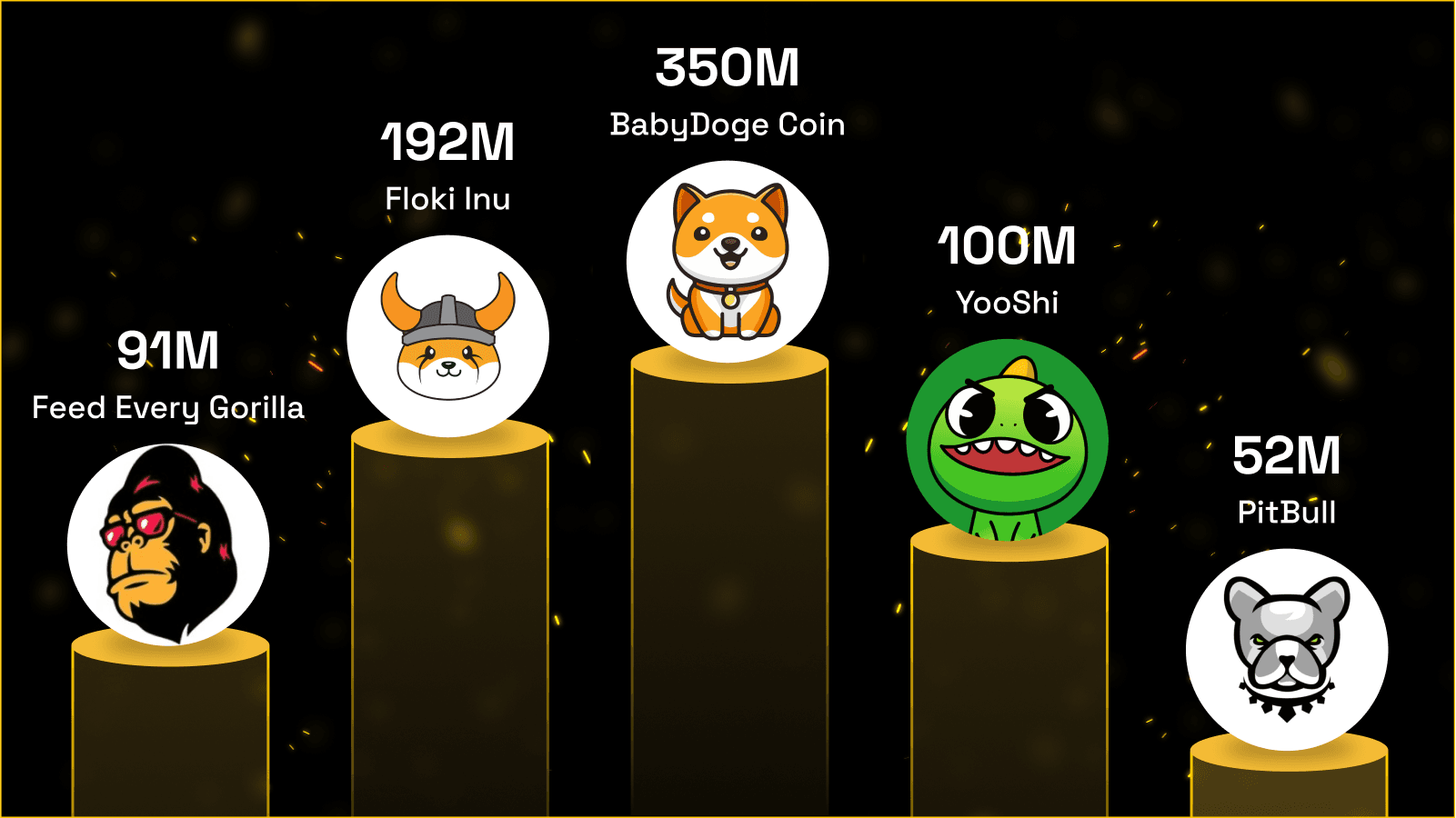

- Some traders made life-changing gains (SafeMoon and Baby Doge investors, looking at you)

- BSC became the #1 alternative to Ethereum, fueling innovation

Losers:

- Scams everywhere – Over 50% of BSC memecoins were rug pulls or outright scams

- Volatility was insane – Some projects lost 90-99% of their value within weeks

- Whales played games – Pump-and-dumps happened daily, leaving retail holding the bag

Final Thoughts: The Wild Ride That Changed Everything

2021 was chaotic, reckless, and legendary. BSC redefined memecoin trading, giving power to retail traders who were willing to take risks. The year proved that internet culture, community-driven hype, and market speculation could birth millionaires overnight—but it also showed how easily those same markets could crash and burn.

Memecoins aren’t dead. They never will be. But the lessons of 2021? Those will stick around forever.